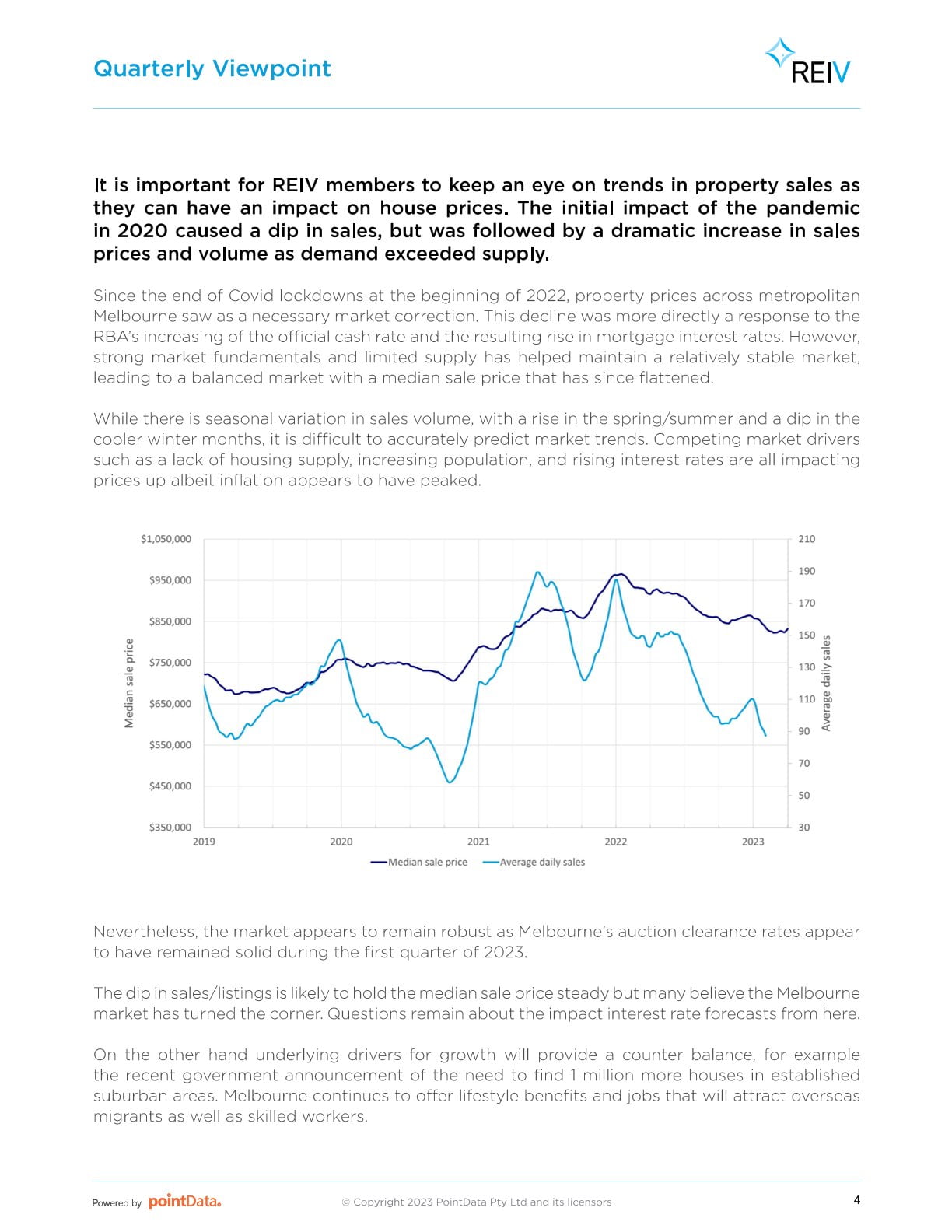

It is important for REIV members to keep an eye on trends in property sales as they can have an impact on house prices. The initial impact of the pandemic in 2020 caused a dip in sales but was followed by a dramatic increase in sales prices and volume as demand exceeded supply.

Since the end of Covid lockdowns at the beginning of 2022, property prices across metropolitan Melbourne saw a necessary market correction. This decline was more directly a response to the RBA’s increasing of the official cash rate and the resulting rise in mortgage interest rates. However, strong market fundamentals and limited supply have helped maintain a relatively stable market, leading to a balanced market with a median sale price that has since flattened.

While there is seasonal variation in sales volume, with a rise in the spring/summer and a dip in the cooler winter months, it is difficult to accurately predict market trends. Competing market drivers such as a lack of housing supply, increasing population, and rising interest rates are all impacting prices albeit inflation appears to have peaked.

Nevertheless, the market appears to remain robust as Melbourne’s auction clearance rates appear to have remained solid during the first quarter of 2023.

The dip in sales/listings is likely to hold the median sale price steady but many believe the Melbourne market has turned the corner. Questions remain about the impact of interest rate forecasts from here.

On the other hand, underlying drivers for growth will provide a counterbalance, for example, the recent government announcement of the need to find 1 million more houses in established suburban areas. Melbourne continues to offer lifestyle benefits and jobs that will attract overseas migrants as well as skilled workers.