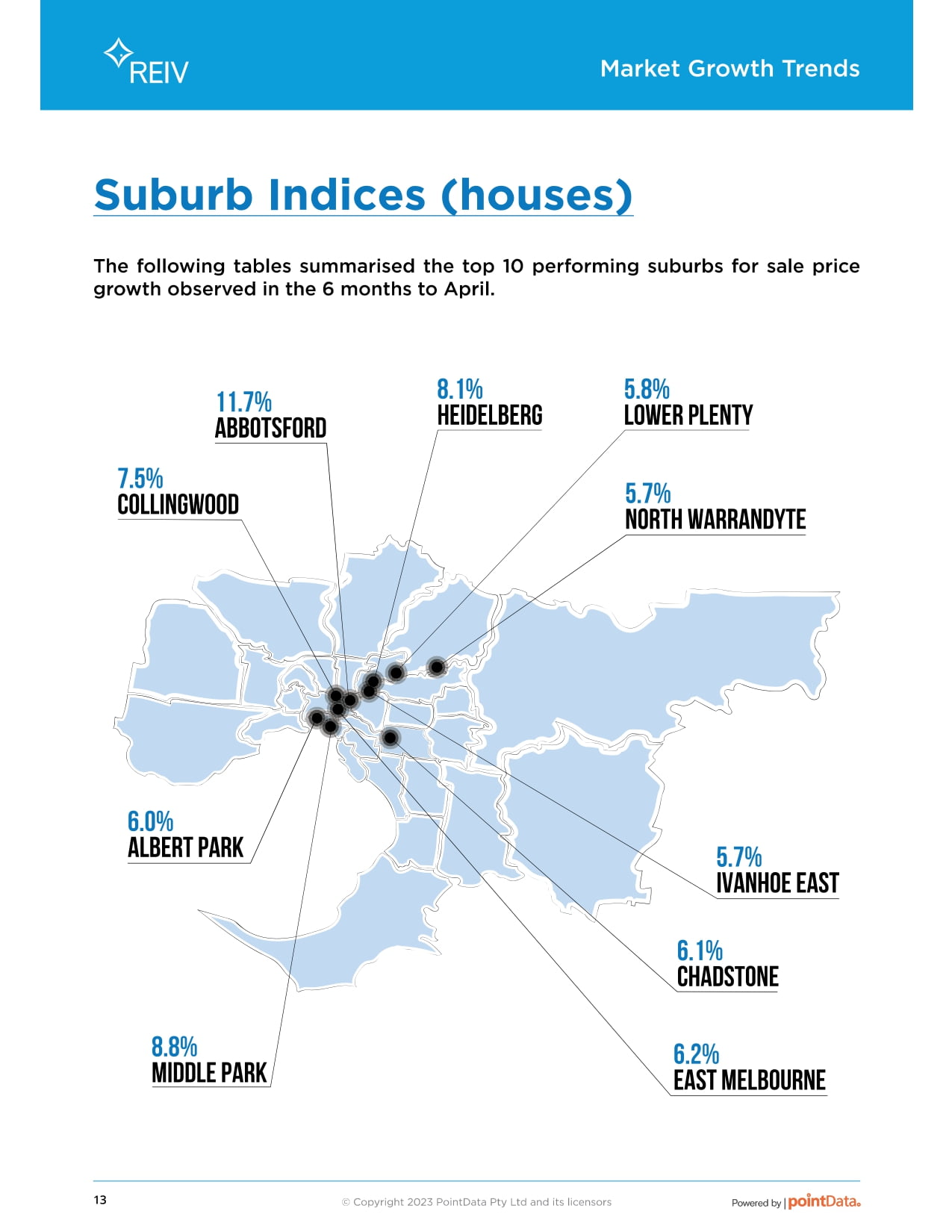

The following tables summarise the top 10 performing suburbs for sale price

growth observed in the 6 months to April.

Suburb Indices (houses)

Market Growth Trends

Powered by

LOWER PLENTY

5.8%

NORTH WARRANDYTE

5.7%

HEIDELBERG

8.1%

COLLINGWOOD

7.5%

CHADSTONE

6.1%

EAST MELBOURNE

6.2%

ALBERT Park

6.0%

MIDDLE PARK

8.8%

IVANHOE EAST

5.7%

ABBOTSFORD

11.7%

Market Growth Trends

Suburbs with the highest 6-month value growth can be found in the east

and north-east, with many suburbs along or close to the Yarra River. All of

the suburbs featured in the 6-month growth table have median sales prices

above the Metropolitan Melbourne median of $956,000 and are all $1 million

suburbs.

Suburb 6-month growth (houses) Median sale price

Abbotsford 11.7% $1,651,700

Middle Park 8.8% $2,300,000

Heidelberg 8.1% $1,310,400

Collingwood 7.5% $1,624,900

East Melbourne 6.2% $1,443,100

Chadstone 6.1% $1,449,200

Albert Park 6.0% $2,197,500

Lower Plenty 5.8% $1,240,000

North Warrandyte 5.7% $1,691,600

Ivanhoe East 5.7% $1,950,000

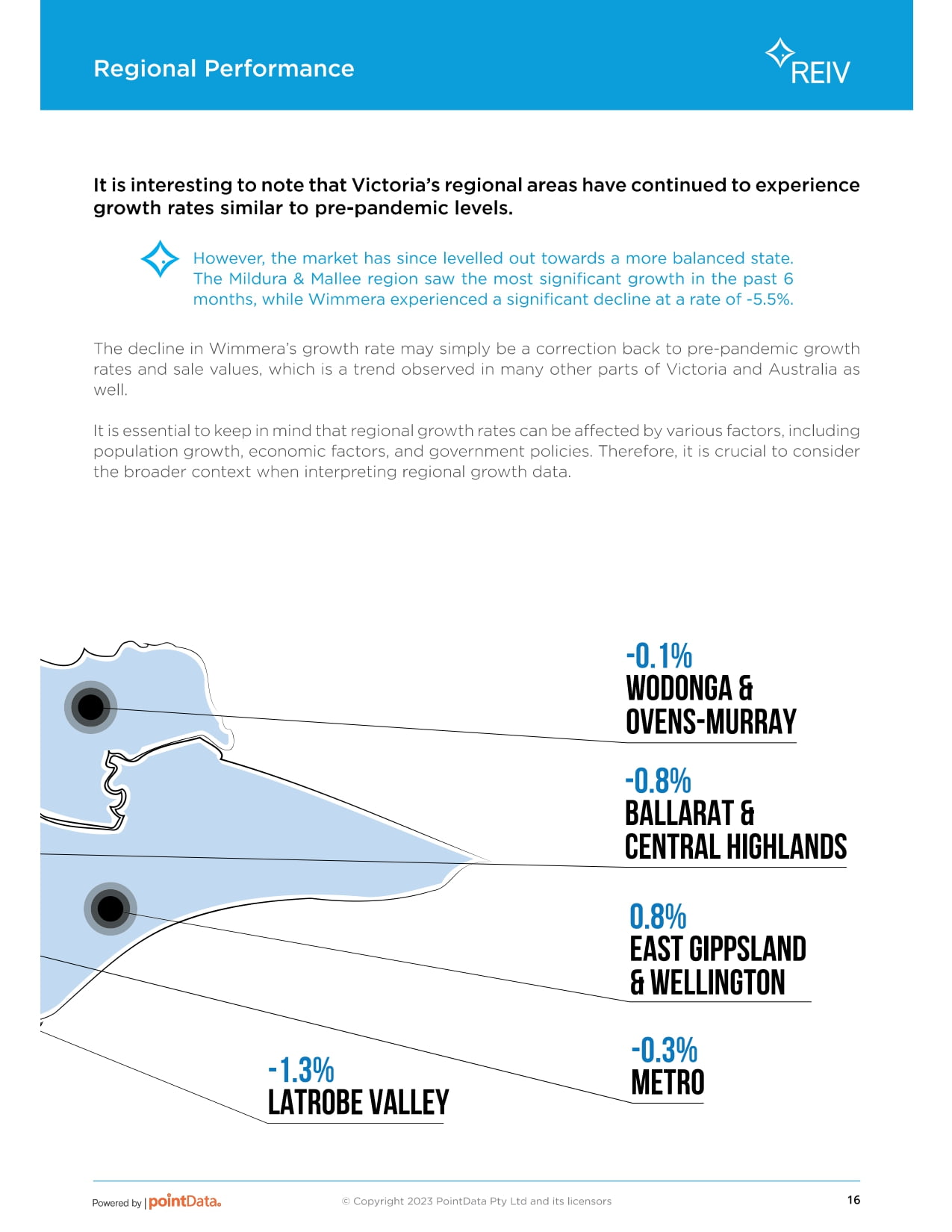

East Gippsland

& Wellington

0.8%

Latrobe Valley

Warrnambool & -1.3%

Western District

-1.2% Geelong

& Barwon

-1.6%

Wodonga &

Ovens-Murray

-0.1%

Metro

-0.3%

Ballarat &

Central Highlands

-0.8%

Shepparton

& Goulburn

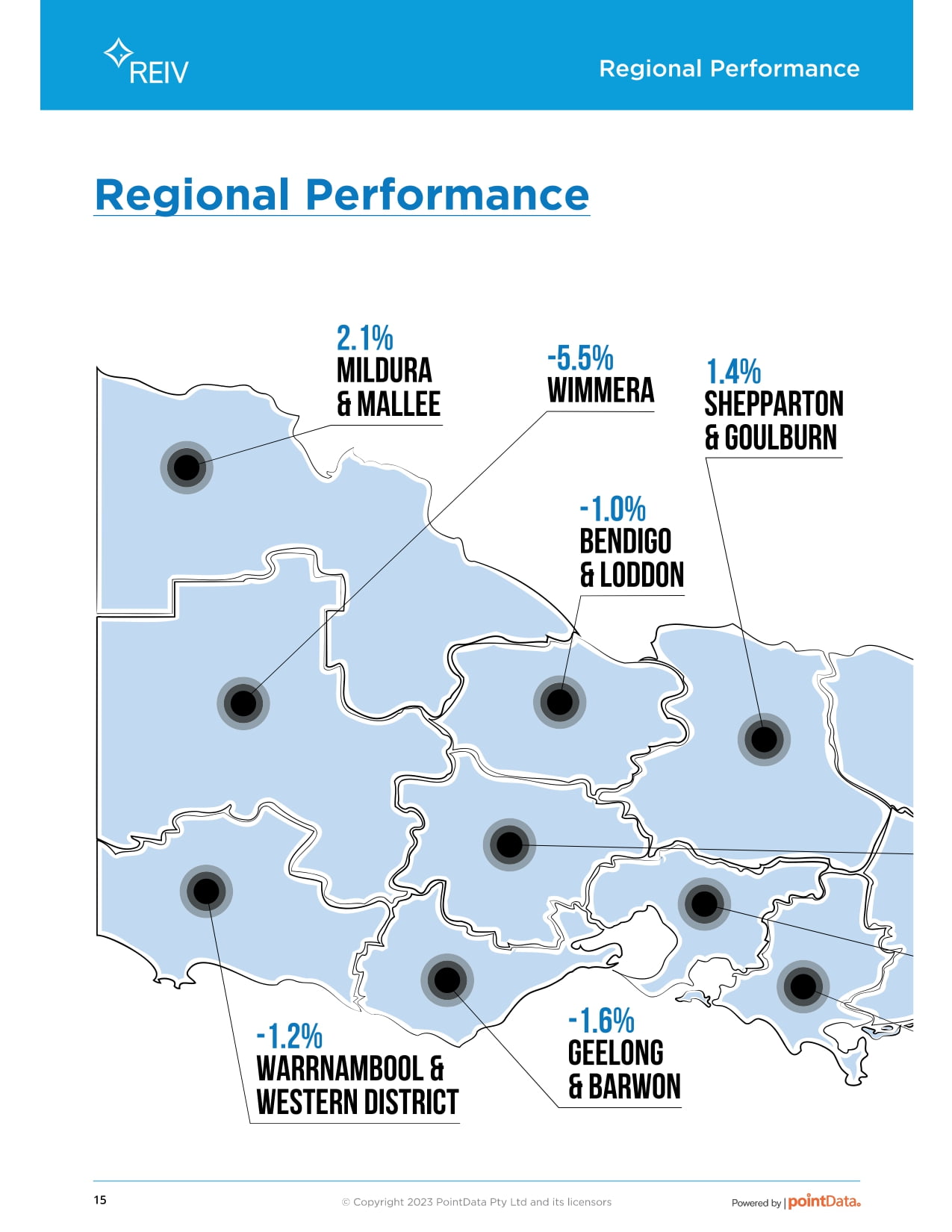

Mildura 1.4%

& Mallee

2.1%

Wimmera

-5.5%

Bendigo

& Loddon

-1.0%

Regional Performance

East Gippsland

& Wellington

0.8%

Latrobe Valley

Warrnambool & -1.3%

Western District

-1.2% Geelong

& Barwon

-1.6%

Wodonga &

Ovens-Murray

-0.1%

Metro

-0.3%

Ballarat &

Central Highlands

-0.8%

Shepparton

& Goulburn

Mildura 1.4%

& Mallee

2.1%

Wimmera

-5.5%

Bendigo

& Loddon

-1.0%

Regional Performance

It is interesting to note that Victoria’s regional areas have continued to experience

growth rates similar to pre-pandemic levels.

However, the market has since levelled out towards a more balanced state.

The Mildura & Mallee region saw the most significant growth in the past 6

months, while Wimmera experienced a significant decline at a rate of -5.5%.

The decline in Wimmera’s growth rate may simply be a correction back to pre-pandemic growth

rates and sale values, which is a trend observed in many other parts of Victoria and Australia as

well.

It is essential to keep in mind that regional growth rates can be affected by various factors, including

population growth, economic factors, and government policies. Therefore, it is crucial to consider

the broader context when interpreting regional growth data.

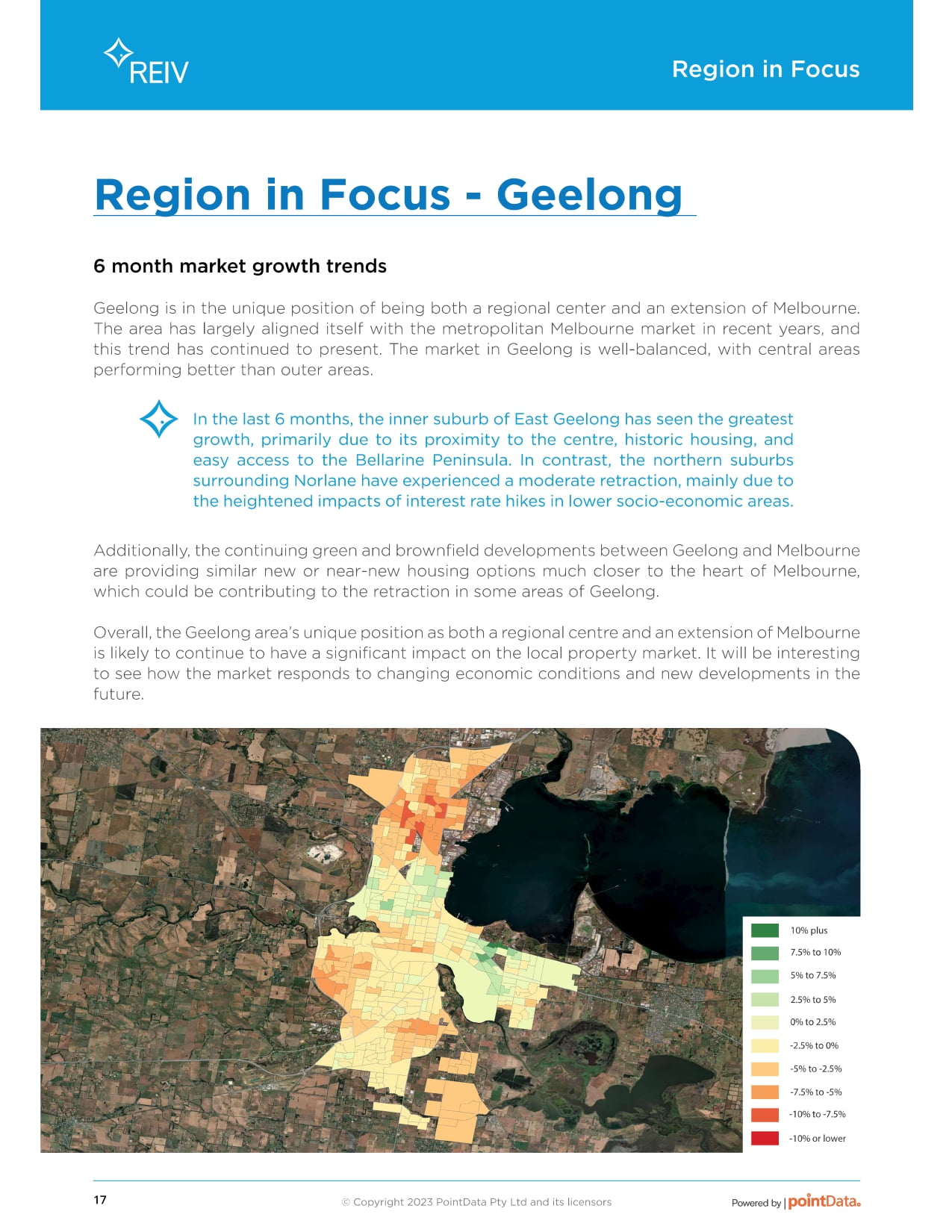

6-month market growth trends

Geelong is in the unique position of being both a regional centre and an extension of Melbourne.

The area has largely aligned itself with the metropolitan Melbourne market in recent years, and

this trend has continued to present. The market in Geelong is well-balanced, with central areas

performing better than outer areas.

In the last 6 months, the inner suburb of East Geelong has seen the greatest

growth, primarily due to its proximity to the centre, historic housing, and

easy access to the Bellarine Peninsula. In contrast, the northern suburbs

surrounding Norlane have experienced a moderate retraction, mainly due to

the heightened impacts of interest rate hikes in lower socio-economic areas.

Additionally, the continuing green and brownfield developments between Geelong and Melbourne

are providing similar new or near-new housing options much closer to the heart of Melbourne,

which could be contributing to the retraction in some areas of Geelong.

Overall, the Geelong area’s unique position as both a regional centre and an extension of Melbourne

is likely to continue to have a significant impact on the local property market. It will be interesting

to see how the market responds to changing economic conditions and new developments in the

future.

Property Price Trends Region in Focus - Geelong 17

Region in Focus

-10% to -7.5%

-10% or lower

-7.5% to -5%

-5% to -2.5%

-2.5% to 0%

0% to 2.5%

2.5% to 5%

5% to 7.5%

7.5% to 10%

10% plus

Median Sale Price

It is not surprising that the median sale prices within Geelong differ based on the varying levels

of amenities. Like many major cities, the inner areas that contain the bulk of Geelong’s desirable

character housing dictate the highest price points. The amenities provided by the Barwon River

and Queens Park further add to the area’s desirability.

As is common in larger cities, median sale prices tend to decrease outwards

from the centre. Efforts to increase housing supply in Melbourne

and Geelong have saturated the market with new housing stock, creating

a starkly different proposition from the relatively close established areas of

Geelong.

This supply has proven significant enough to ensure options in these areas remain affordable

amidst supply and demand imbalances elsewhere in Victoria and Australia.

Overall, the varying median sale prices in Geelong are likely to continue

reflecting the desirability of different areas, as well as the impact of new

housing supply and other economic factors.

It will be interesting to see how the property market in Geelong evolves in the coming years,

particularly as the city continues to position itself as both a regional centre and an extension of

Melbourne.

$500K or lower

$500K to $600K

$600K to $700K

$700K to $800K

$800K to $900K

$900K to $1M

$1M plus