Economy

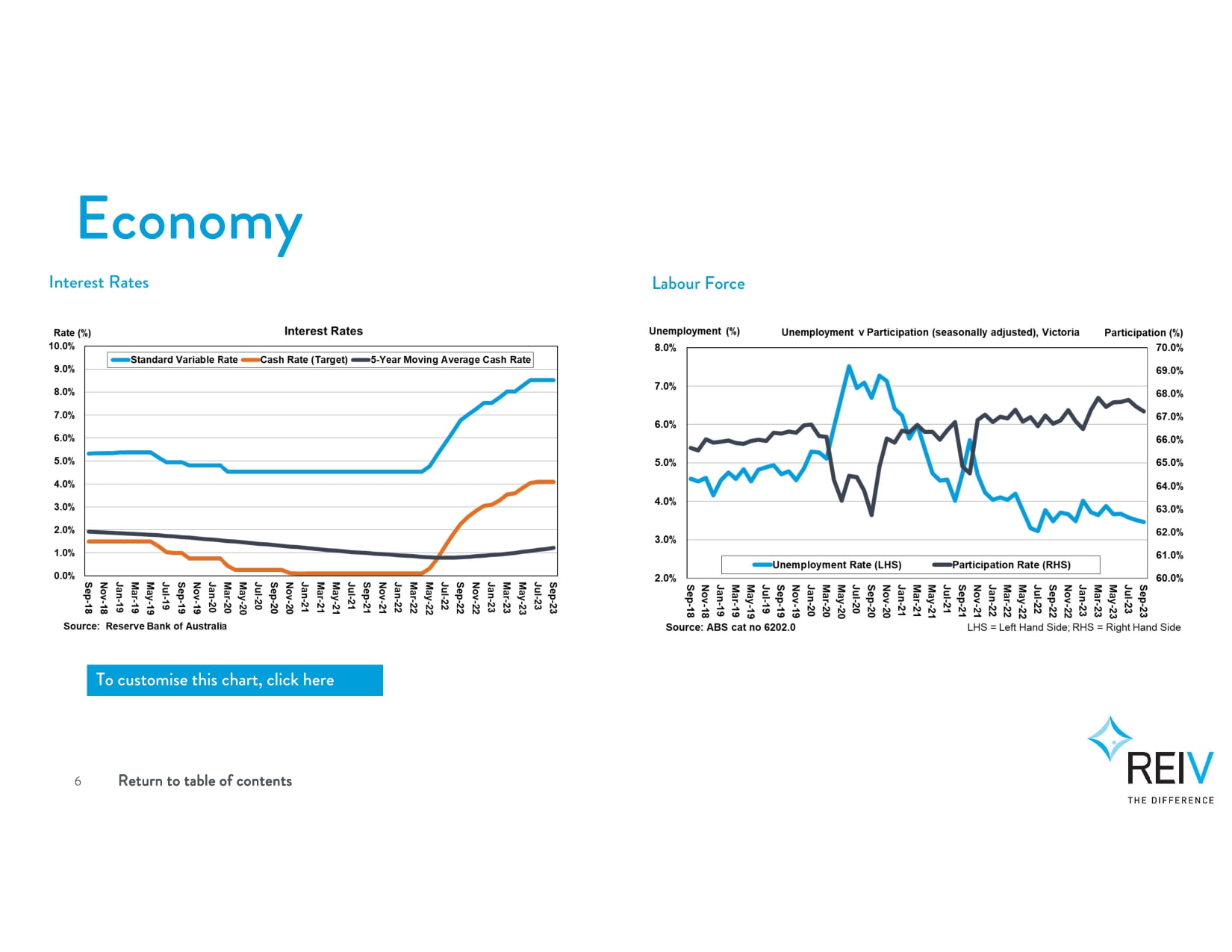

Following the Reserve Bank meeting in October 2023, the cash rate remained unchanged at 4.10 per cent.

Interest rates have been increased by 4 percentage points since May last year. The higher interest rates are working to establish a more sustainable balance between supply and demand in the economy. Inflation in Australia has passed its peak but is still too high and will remain so for some time yet. The central forecast is for CPI inflation to continue to decline and to be back within the 2-3 per cent target range in late 2025.

Growth in the Australian economy was a little stronger than expected over the first half of the year. But the economy is still experiencing a period of below-trend growth and this is expected to continue for a while. High inflation is weighing on people's real incomes and household consumption growth is weak, as is dwelling investment.

According to the ABS, the seasonally adjusted unemployment rate for Australia fell 0.1 percentage point to 3.6 per cent in September, with employment increasing slightly, by around 6,700 people, and the number of unemployed people falling by around 19,800. The fall in the unemployment rate in September mainly reflected a higher proportion of people moving from being unemployed to not in the labour force.

The participation rate in Victoria saw 0.2 percentage points decrease over the month to 67.2 per cent while the unemployment rate remained unchanged at 3.5 per cent.