Economy

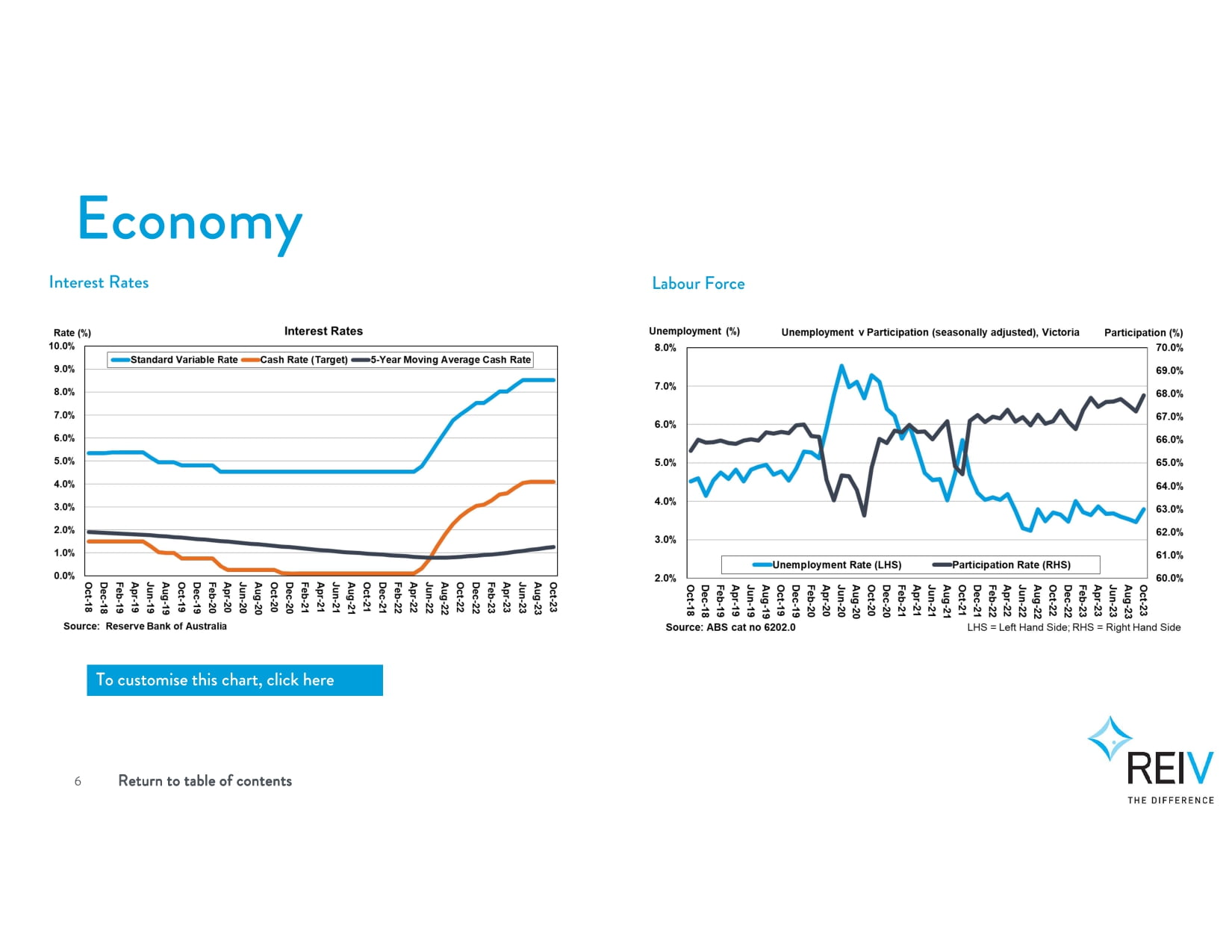

Following the Reserve Bank meeting in November 2023, the cash rate has been increased by 25 basis points to 4.35 per cent.

Inflation in Australia has passed its peak but is still too high and is proving more persistent than expected a few months ago. The latest reading on CPI inflation indicates that while goods price inflation has eased further, the prices of many services are continuing to rise briskly. CPI inflation is now expected to be around 31⁄2 per cent by the end of 2024 and at the top of the target range of 2 to 3 per cent by the end of 2025.

High inflation is weighing on people's real incomes and household consumption growth is weak, as is dwelling investment. Given that the economy is forecast to grow below trend, employment is expected to grow slower than the labour force and the unemployment rate is expected to rise gradually to around 4 per cent. Wages growth has picked up over the past year but is still consistent with the inflation target, provided that productivity growth picks up.

According to the ABS, the seasonally adjusted unemployment rate for Australia increased by 0.2 percentage points to 3.7 per cent in October, with employment increasing by 55,000 people, and the number of unemployed people increasing by 27,900. The large increase in employment in October followed a small increase in September of around 8,000 people.

The participation rate in Victoria saw 0.7 percentage points increase to 67.9 per cent in October, biggest gain for the month alongside Northern Territory, while the unemployment rate also went up by 0.3 percentage points to 3.8 per cent.