Economy

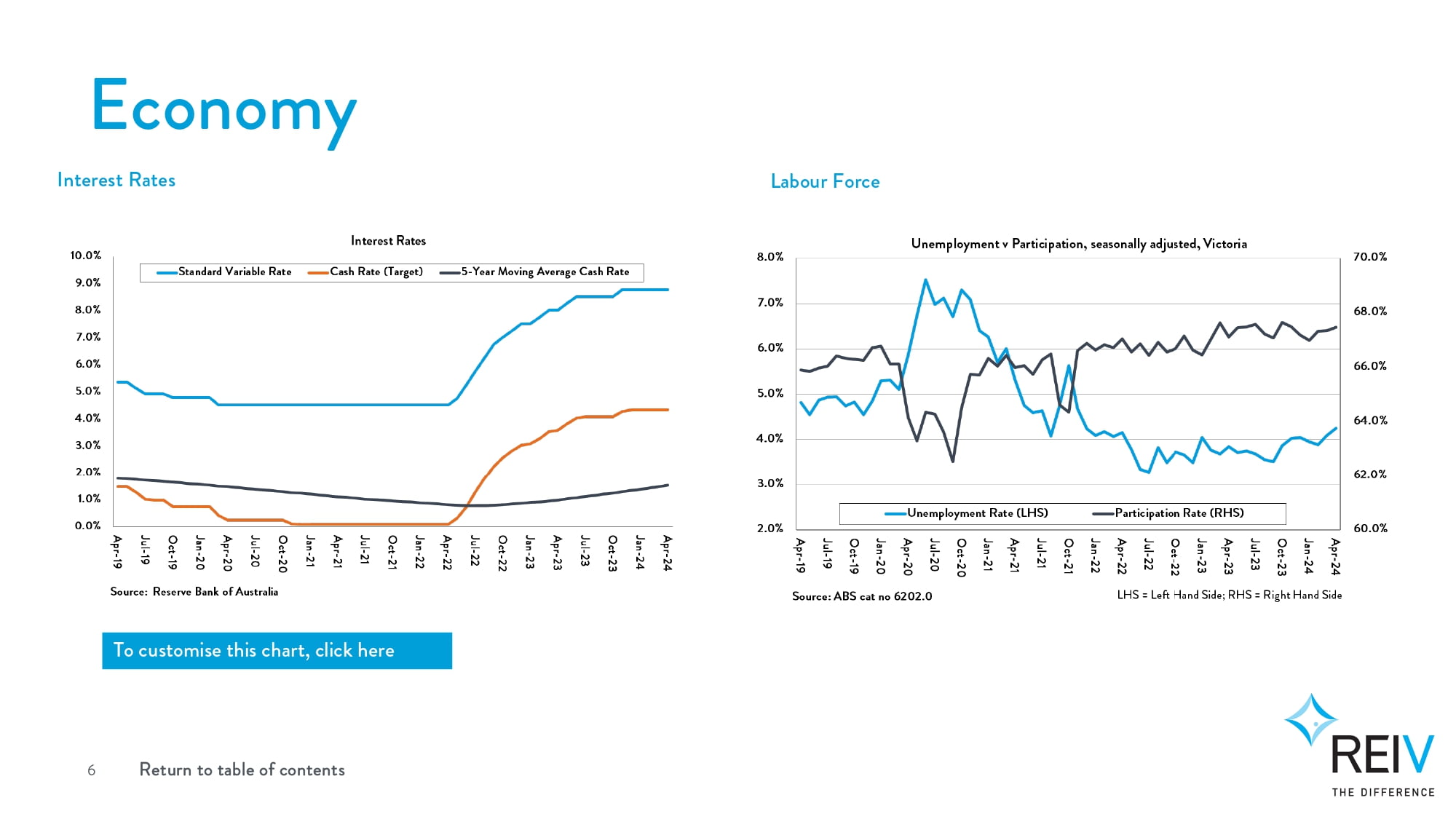

Following the Reserve Bank meeting in May 2024, the cash rate remained unchanged at 4.35 per cent.

Inflation continues to moderate but is declining more slowly than expected. The CPI quarter, down from 4.1 per cent over the year to December. Underlying inflation was higher than headline inflation and declined by less. This was due in large part to services inflation, which remains high and is moderating only gradually.

grew by 3.6 per cent over the year to March

The central forecasts are for inflation to return to the target range of 2-3 per cent in the second half of 2025, and to the midpoint in 2026. In the near term, inflation is forecast to be higher because of the recent rise in domestic petrol prices, and higher than expected services price inflation, which is now forecast to decline more slowly over the rest of the year. Inflation is, however, expected to decline over 2025 and 2026.

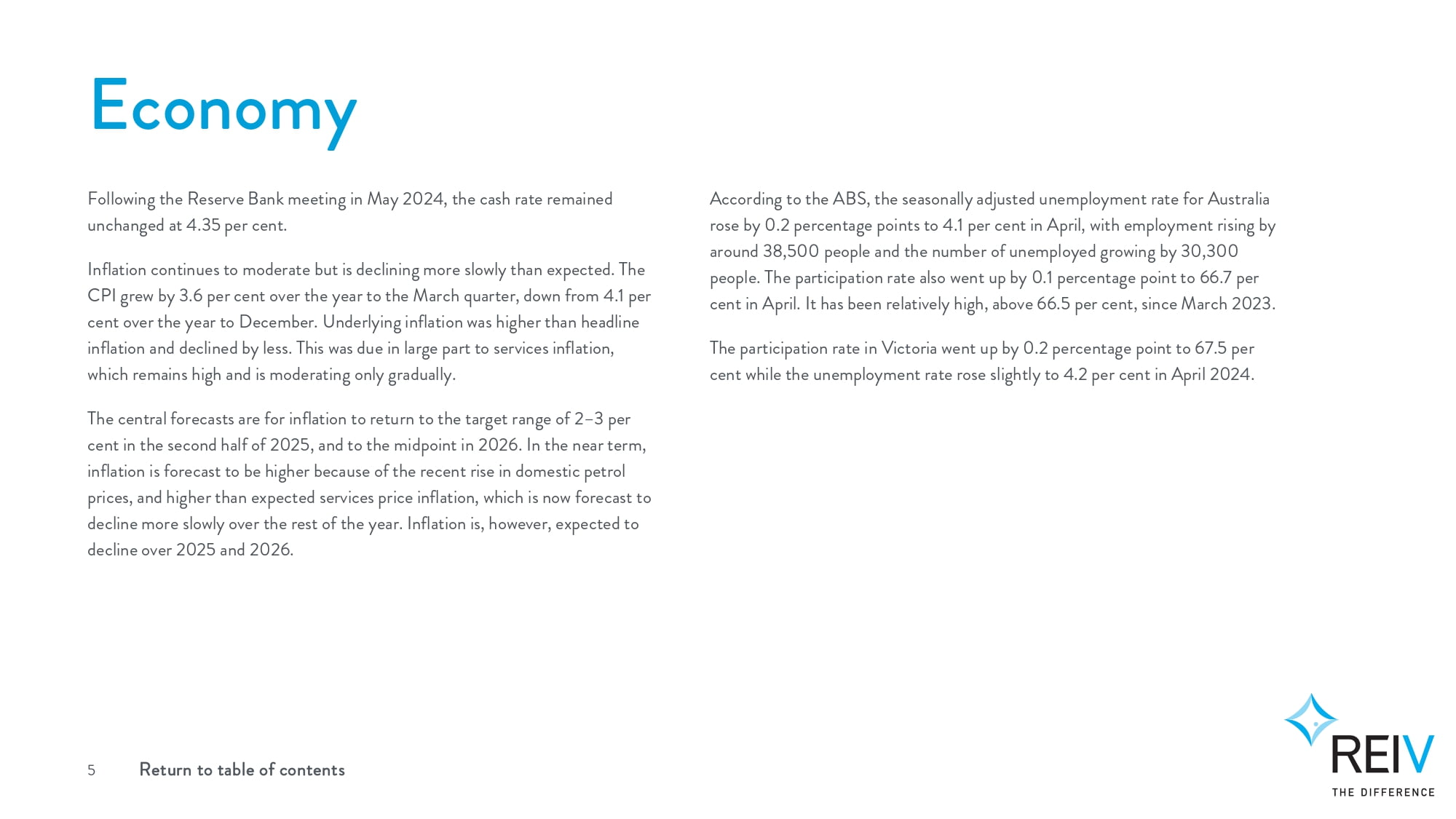

According to the ABS, the seasonally adjusted unemployment rate for Australia rose by 0.2 percentage points to 4.1 per cent in April, with employment rising by around 38,500 people and the number of unemployed growing by 30,300 people. The participation rate also went up by 0.1 percentage point to 66.7 per cent in April. It has been relatively high, above 66.5 per cent, since March 2023. The participation rate in Victoria went up by 0.2 percentage point to 67.5 per cent while the unemployment rate rose slightly to 4.2 per cent in April 2024.