Economy

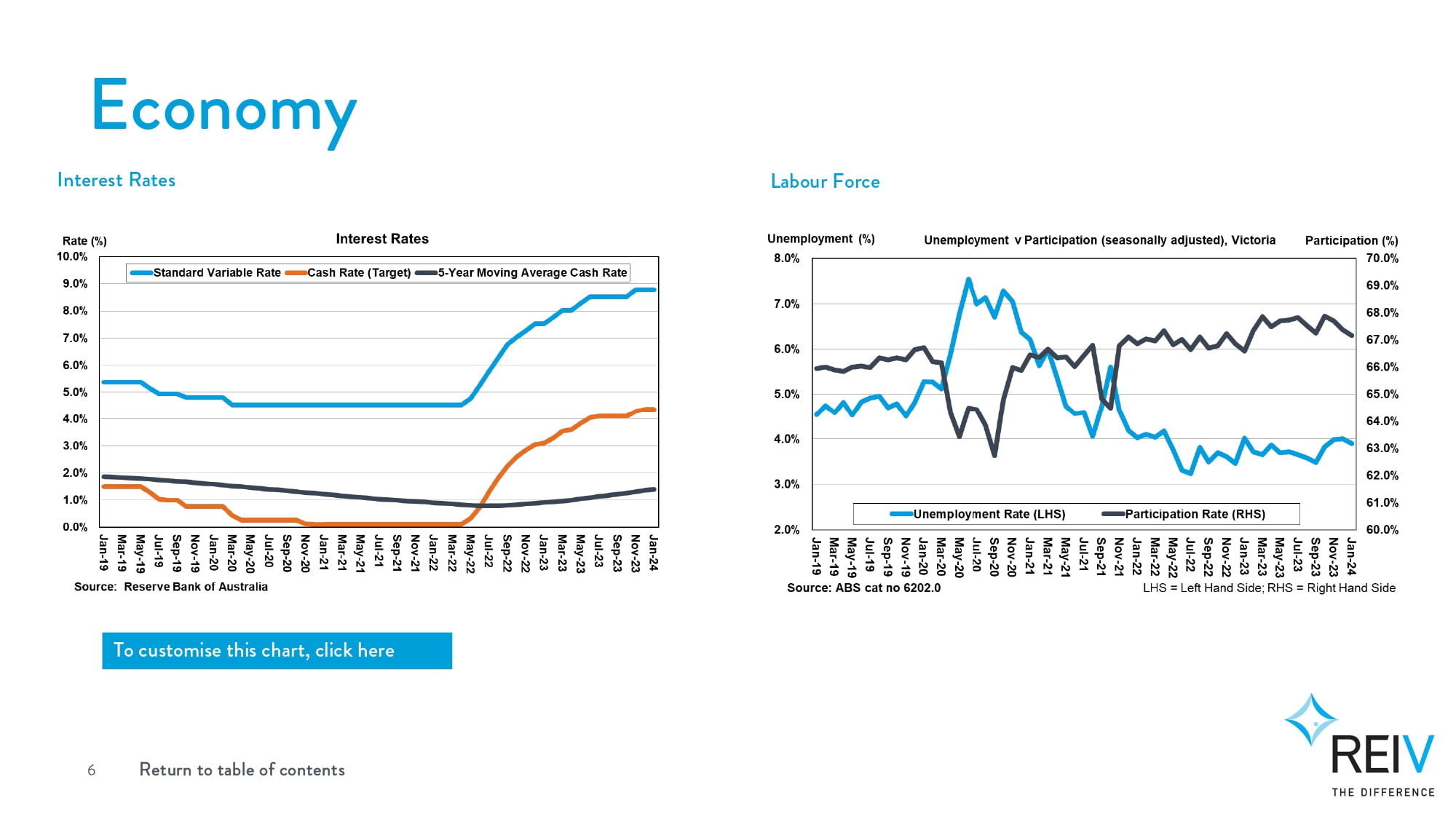

Following the Reserve Bank meeting in February 2024, the cash rate remained unchanged at 4.35 per cent.

Inflation continued to ease in the December quarter, but it remains high at 4.1 per cent. Goods price inflation has continued to ease, reflecting the resolution of earlier global supply chain disruptions and a moderation in domestic demand for goods. Services price inflation, however, declined at a more gradual pace in line with the RBA's earlier forecasts and remains high.

While there are encouraging signs, the economic outlook is uncertain, and the RBA remains highly attentive to inflation risks. The central forecasts are for inflation to return to the target range of 2-3 per cent in 2025, and to the midpoint in 2026.

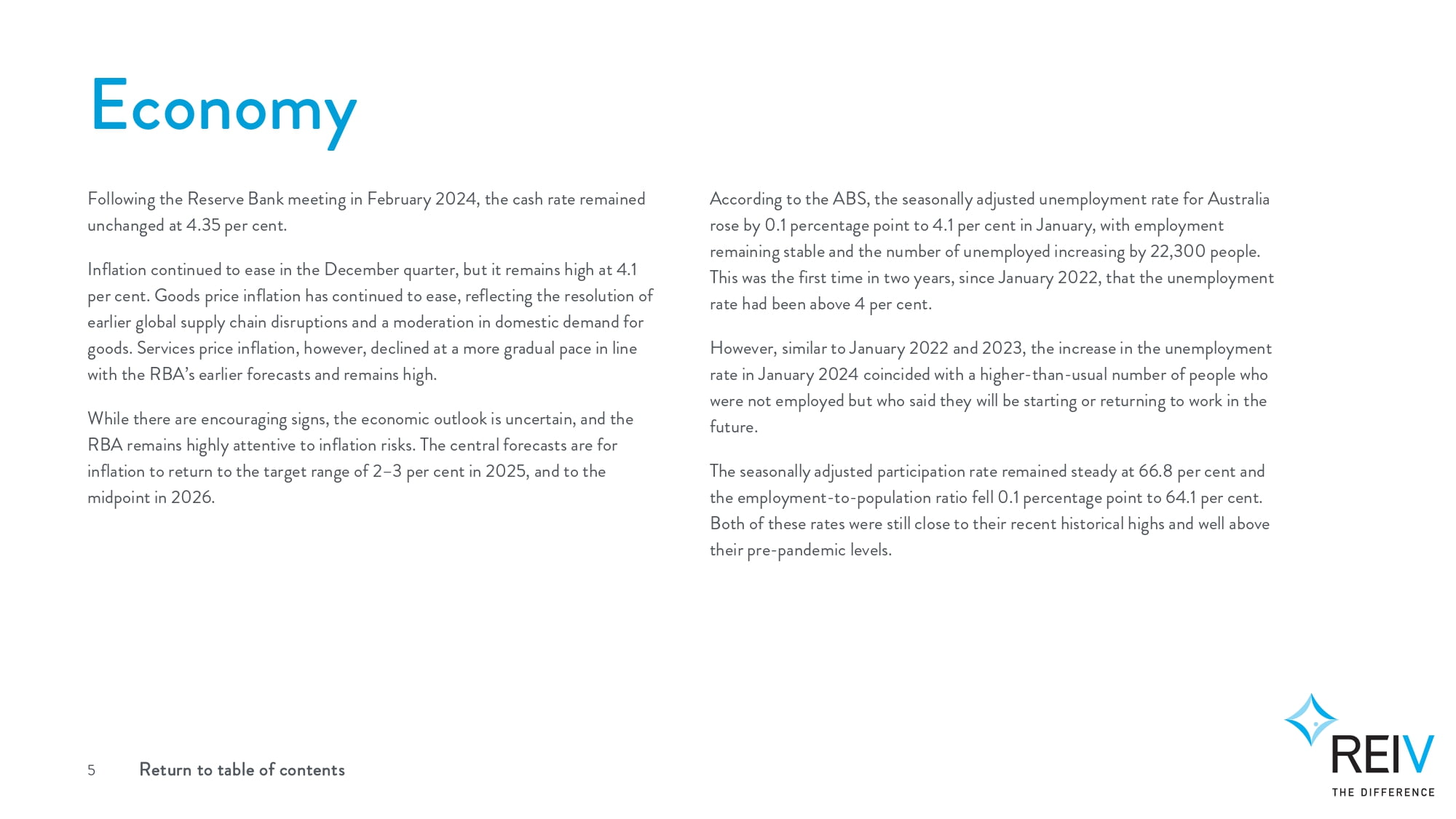

According to the ABS, the seasonally adjusted unemployment rate for Australia rose by 0.1 percentage point to 4.1 per cent in January, with employment remaining stable and the number of unemployed increasing by 22,300 people. This was the first time in two years, since January 2022, that the unemployment rate had been above 4 per cent.

However, similar to January 2022 and 2023, the increase in the unemployment rate in January 2024 coincided with a higher-than-usual number of people who were not employed but who said they will be starting or returning to work in the future.

The seasonally adjusted participation rate remained steady at 66.8 per cent and the employment-to-population ratio fell 0.1 percentage point to 64.1 per cent. Both of these rates were still close to their recent historical highs and well above their pre-pandemic levels.