Economy

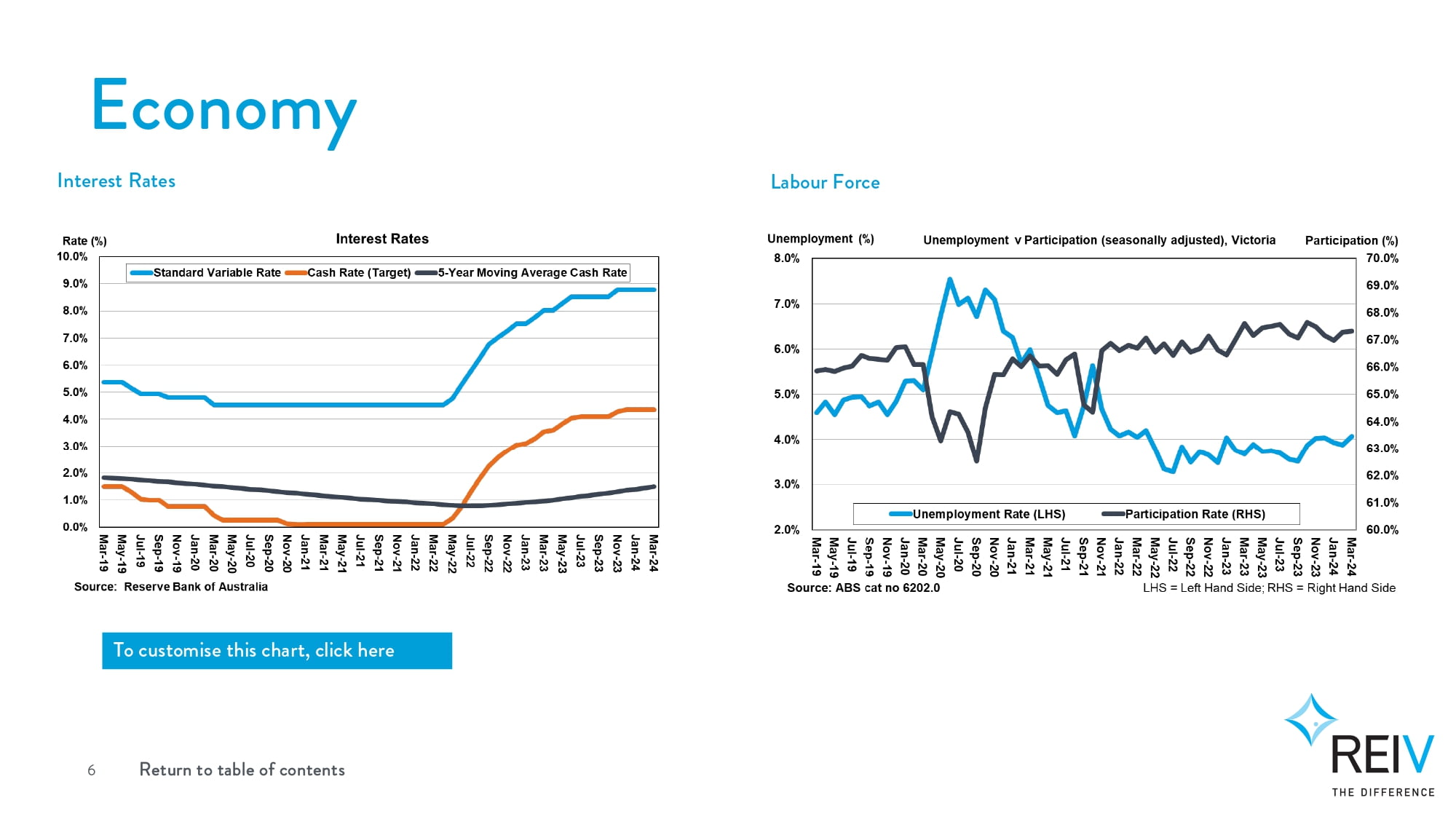

Following the Reserve Bank meeting in March 2024, the cash rate remained unchanged at 4.35 per cent.

Inflation continued to moderate as the headline monthly CPI indicator was

steady at 3.4 per cent over the year to January, with momentum easing over

recent months. Services inflation remains elevated and is moderating at a more gradual pace.

While there are encouraging signs, the economic outlook remains uncertain. The December quarter national accounts data confirmed growth has slowed. Household consumption growth remains particularly weak amid high inflation and the rise in interest rates. The central forecasts are for inflation to return to the target range of 2-3 per cent in 2025, and to the midpoint in 2026.

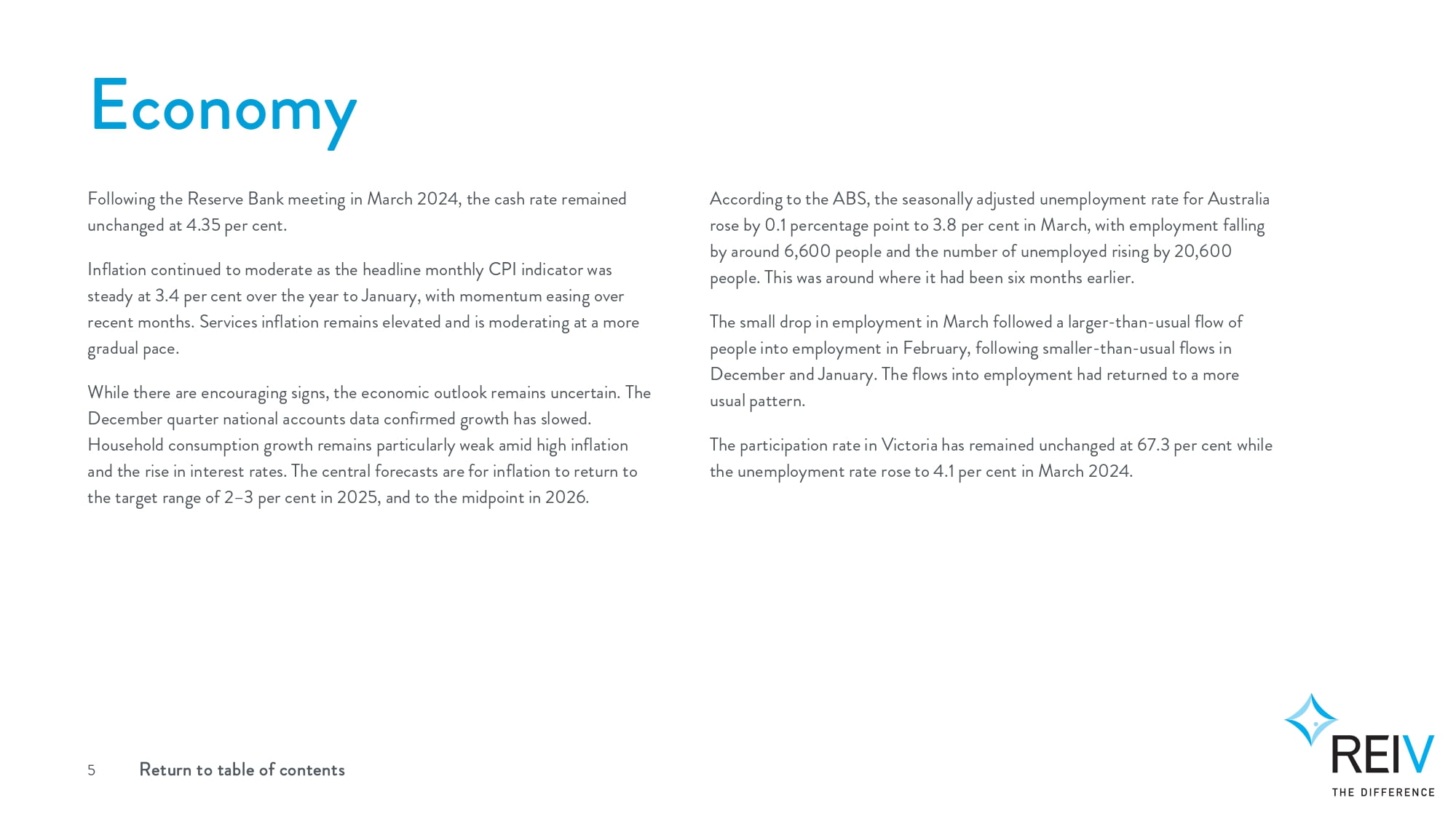

According to the ABS, the seasonally adjusted unemployment rate for Australia rose by 0.1 percentage point to 3.8 per cent in March, with employment falling by around 6,600 people and the number of unemployed rising by 20,600 people. This was around where it had been six months earlier.

The small drop in employment in March followed a larger-than-usual flow of people into employment in February, following smaller-than-usual flows in December and January. The flows into employment had returned to a more usual pattern.

The participation rate in Victoria has remained unchanged at 67.3 per cent while the unemployment rate rose to 4.1 per cent in March 2024.