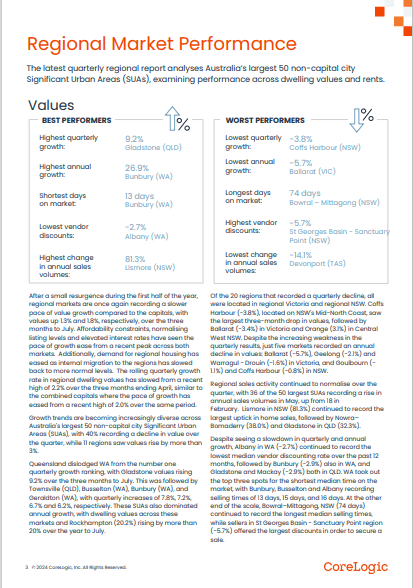

Regional Market Performance - Values

The latest quarterly regional report analyses Australia’s largest 50 non-capital city

Significant Urban Areas (SUAs), examining performance across dwelling values and rents. After a small resurgence during the first half of the year, regional markets are once again recording a slower pace of value growth compared to the capitals, with values up 1.3% and 1.8%, respectively, over the three months to July. Affordability constraints, normalising listing levels and elevated interest rates have seen the pace of growth ease from a recent peak across both markets. Additionally, demand for regional housing has eased as internal migration to the regions has slowed back to more normal levels. The rolling quarterly growth rate in regional dwelling values has slowed from a recent high of 2.2% over the three months ending April, similar to the combined capitals where the pace of growth has

eased from a recent high of 2.0% over the same period. Growth trends are becoming increasingly diverse across

Australia's largest 50 non-capital city Significant Urban Areas (SUAs), with 40% recording a decline in value over

the quarter, while 11 regions saw values rise by more than 3%.

Queensland dislodged WA from the number one quarterly growth ranking, with Gladstone values rising 9.2% over the three months to July. This was followed by Townsville (QLD), Busselton (WA), Bunbury (WA), and Geraldton (WA), with quarterly increases of 7.8%, 7.2%, 6.7% and 6.2%, respectively. These SUAs also dominated annual growth, with dwelling values across these markets and Rockhampton (20.2%) rising by more than 20% over the year to July. Of the 20 regions that recorded a quarterly decline, all were located in regional Victoria and regional NSW. Coffs Harbour (-3.8%), located on NSW's Mid-North Coast, saw the largest three-month drop in values, followed by

Ballarat (-3.4%) in Victoria and Orange (3.1%) in Central West NSW. Despite the increasing weakness in the quarterly results,

just five markets recorded an annual decline in values:

Ballarat (-5.7%),

Geelong (-2.1%) and

Warragul - Drouin (-1.6%)

in Victoria, and Goulbourn (-

1.1%) and Coffs Harbour (-0.8%) in NSW.

Regional sales activity continued to normalise over the quarter, with 36 of the 50 largest SUAs recording a rise in annual sales volumes in May, up from 18 in February. Lismore in NSW (81.3%) continued to record the

largest uptick in home sales, followed by Nowra–Bomaderry (38.0%) and Gladstone in QLD (32.3%). Despite seeing a slowdown in quarterly and annual growth, Albany in WA (-2.7%) continued to record the lowest median vendor discounting rate over the past 12 months, followed by Bunbury (-2.9%) also in WA, and Gladstone and Mackay (-2.9%) both in QLD. WA took out the top three spots for the shortest median time on the market, with Bunbury, Busselton and Albany recording selling times of 13 days, 15 days, and 16 days. At the other end of the scale, Bowral–Mittagong, NSW (74 days) continued to record the longest median selling times, while sellers in St Georges Basin - Sanctuary Point region (-5.7%) offered the largest discounts to secure a sale

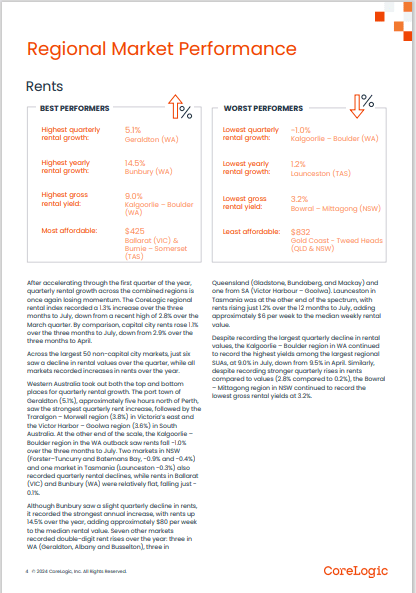

Regional Market Performance - Rents

After accelerating through the first quarter of the year, quarterly rental growth across the combined regions is once again losing momentum. The CoreLogic regional rental index recorded a 1.3% increase over the three months to July, down from a recent high of 2.8% over the March quarter. By comparison, capital city rents rose 1.1%

over the three months to July, down from 2.9% over the three months to April. Across the largest 50 non-capital city markets, just six saw a decline in rental values over the quarter, while all markets recorded increases in rents over the year. Western Australia took out both the top and bottom places for quarterly rental growth. The port town of

Geraldton (5.1%), approximately five hours north of Perth, saw the strongest quarterly rent increase, followed by the

Traralgon – Morwell region (3.8%) in Victoria’s east and the Victor Harbor – Goolwa region (3.6%) in South

Australia. At the other end of the scale, the Kalgoorlie – Boulder region in the WA outback saw rents fall -1.0%

over the three months to July.

Two markets in NSW (Forster–Tuncurry and Batemans Bay, -0.9% and -0.4%)

and one market in Tasmania (Launceston -0.3%) also recorded quarterly rental declines, while rents in Ballarat

(VIC) and Bunbury (WA) were relatively flat, falling just -0.1%. Although Bunbury saw a slight quarterly decline in rents, it recorded the strongest annual increase, with rents up 14.5% over the year, adding approximately $80 per week to the median rental value. Seven other markets recorded double-digit rent rises over the year: three in

WA (Geraldton, Albany and Busselton), three in Queensland (Gladstone, Bundaberg, and Mackay) and one from SA (Victor Harbour – Goolwa). Launceston in Tasmania was at the other end of the spectrum, with rents rising just 1.2% over the 12 months to July, adding approximately $6 per week to the median weekly rental

value. Despite recording the largest quarterly decline in rental values, the Kalgoorlie – Boulder region in WA continued to record the highest yields among the largest regional SUAs, at 9.0% in July, down from 9.5% in April. Similarly, despite recording stronger quarterly rises in rents compared to values (2.8% compared to 0.2%), the Bowral–Mittagong region in NSW continued to record the lowest gross rental yield